Survey Points to Big Overspend on Accountants

17/12/2015 – Business

The small businesses that are the lifeblood of the UK economy generally work on incredibly tight margins. They will therefore be shocked to hear that a recent survey has highlighted the fact that many of them may be significantly overpaying for their accounts.

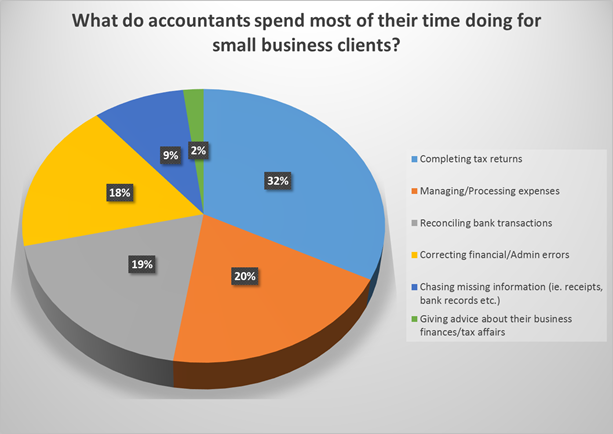

ICB accredited software provider, FreeAgent, conducted a survey on the work that accountants do for SMEs and it produced some shocking results:

The chart above reveals that the 100 surveyed accountants spent 98% of their time with small business clients focusing on administrative and bookkeeping tasks. ‘Completing tax returns’, ‘Managing/Processing expenses’, ‘Reconciling bank transactions’, ‘Correcting financial/Admin errors’ and ‘Chasing missing information (ie. receipts, bank records etc.)’ are the mainstay of bookkeeping practices.

Where the training of chartered accountants differs from that of bookkeepers is that the former are trained to give ‘advice about business finances and tax affairs’. This, however, was the area that accountants reported occupying the smallest proportion of their time.

This is deeply worrying when you consider that, according to salary database PayScale, the median chartered accountant’s hourly salary is more than double that of the average bookkeeper’s.

The provision of accounting services to SMEs is an underreported area; despite the fact that 56% of them have sought support and advice from the accountancy profession at some stage. As a result, it’s hard to know how widespread the culture of overspending is. However, considering that SMEs account for 99.9% of UK businesses and employ 15.6 million people, this is potentially a problem of national significance.

ICB’s concern is that there may be an assumption amongst SMEs that accountants represent the default financial service provider for their businesses when, in fact, they could receive the same quality of work for a significantly reduced fee.

Bookkeepers need to champion the quality and value for money represented by their profession so that small businesses understand that bookkeepers are the first port of call when organising their finances. As a representative of the UK’s brightest bookkeepers, ICB has no doubt that they are capable of revolutionising an SME’s understanding of its finances. SMEs need to know that a higher price does not necessarily ensure a higher quality of service.